Unlocking the Future of Finance: A Comprehensive Guide to CBDC APK

As cash gradually gives way to digital forms of currency, Central Bank Digital Currency (CBDC) is emerging as a pivotal innovation in the realm of finance. The CBDC APK stands out as a revolutionary application designed to facilitate seamless digital transactions, ensuring a safe, efficient, and user-friendly experience for consumers and businesses alike. In this comprehensive guide, we will explore the ins and outs of CBDC, its unique features, and the advantages it brings to the table.

Central Bank Digital Currency (CBDC) is a digital form of fiat money issued by a country's central bank. Unlike cryptocurrencies, which operate on decentralized networks, CBDCs are regulated and controlled by governmental authorities, providing stability and trust to users. Essentially, CBDC functions as a digital equivalent of physical cash, enabling users to engage in transactions in a digital format.

The rise of CBDCs is a response to the growing demand for efficient and secure payment systems, especially in light of the increasing prevalence of digital transactions. As consumers become more accustomed to using online platforms for banking and shopping, central banks worldwide are exploring the implementation of CBDCs to modernize their monetary systems.

Features of CBDC APK

- Seamless Transactions: One of the most significant advantages of the CBDC APK is its ability to facilitate seamless transactions. Users can send and receive money with just a few taps on their smartphones, eliminating the need for traditional banking processes. This streamlined approach makes it easier for individuals and businesses to conduct transactions quickly and efficiently.

- No Need for Physical Cards: With the CBDC APK, users no longer need to carry physical cards or rely on third-party payment applications. The application allows users to make payments directly using their digital currency, providing a convenient solution for everyday transactions. Whether it's shopping at local stores or paying for online services, the CBDC APK simplifies the payment process.

- Enhanced Security: Security is paramount in the digital age, and the CBDC APK prioritizes the protection of users' personal information and financial assets. The application incorporates advanced encryption methods and multi-factor authentication, ensuring that transactions are conducted securely. Users can have peace of mind knowing that their data is safeguarded against potential cyber threats.

- High Interoperability: The CBDC APK is designed to support a wide range of transactions, allowing users to interact with various merchants and service providers. This interoperability ensures that users can easily make payments across different platforms, further enhancing the convenience of digital transactions.

- User-Friendly Interface: The CBDC APK boasts a user-friendly interface that simplifies the navigation process. Whether you're a tech-savvy individual or someone new to digital payments, the application provides an intuitive experience that caters to all users. This ease of use encourages more people to adopt digital currencies as part of their daily lives.

Advertisement

Benefits of Using CBDC

- Financial Inclusion: One of the most critical advantages of CBDCs is their potential to enhance financial inclusion. By providing a digital payment option that is accessible to everyone, CBDCs can help bridge the gap between those who have access to traditional banking services and those who do not. Individuals in remote areas or underserved communities can participate in the digital economy, promoting economic growth and development.

- Cost-Effective Transactions: CBDCs offer a cost-effective solution for both consumers and businesses. By reducing the reliance on intermediaries, such as banks and payment processors, transaction costs can be significantly lowered. This reduction in fees can result in savings for consumers and higher profit margins for businesses, fostering a more competitive market environment.

- Promotion of Digital Economies: The implementation of CBDCs is likely to stimulate the growth of digital economies. As consumers become more accustomed to using digital currencies for transactions, businesses will be encouraged to innovate and adopt digital solutions. This shift can lead to the development of new products and services tailored to meet the needs of a digital-savvy customer base.

- Supporting Monetary Policy: CBDCs can enhance the effectiveness of monetary policy by providing central banks with real-time data on transaction flows. This information allows central banks to monitor economic activity more accurately and make informed decisions regarding interest rates, inflation control, and other monetary policy measures.

- Reduced Cash Dependency: As societies become more digitized, the dependency on physical cash is likely to decline. CBDCs provide a viable alternative to cash transactions, enabling users to conduct their financial activities without the limitations of physical currency. This shift can also reduce the costs associated with cash handling and distribution for governments and businesses.

How CBDC APK Works

The CBDC APK operates on a secure digital platform that leverages blockchain technology to facilitate transactions. Here's a step-by-step breakdown of how the application works:

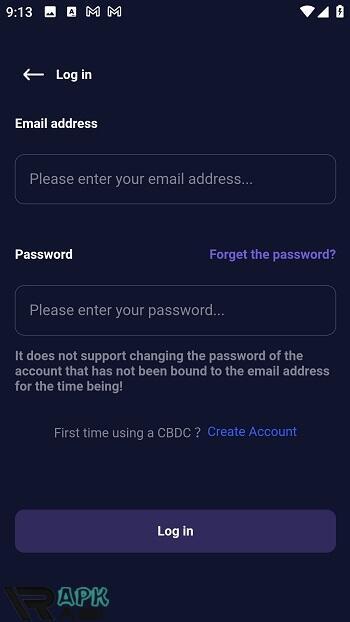

Step 1: User Registration: To start using the CBDC APK, users need to create an account by providing essential information, including their identity and contact details. The application may require users to complete a verification process to ensure compliance with regulatory standards.

Advertisement

Step 2: Fund the Digital Wallet: Once registered, users can fund their digital wallets by linking their bank accounts or transferring digital currency from other sources. This process allows users to maintain a balance within the app, making it easy to conduct transactions whenever needed.

Step 3: Conduct Transactions: With funds available in their digital wallets, users can easily make payments to merchants, transfer money to friends or family, or pay for services. The CBDC APK simplifies this process with an intuitive interface, allowing users to complete transactions within seconds.

Step 4: Transaction Confirmation: After initiating a transaction, users receive instant confirmation of the payment. This immediate feedback enhances the user experience and provides reassurance that the transaction has been successfully completed.

Step 5: Transaction History: The CBDC APK maintains a comprehensive transaction history, allowing users to track their spending and manage their finances effectively. This feature provides valuable insights into users' financial behavior, helping them make informed decisions about their money.

The Future of CBDC

As the world continues to embrace digital transformation, the future of CBDC appears promising. Central banks across the globe are actively exploring and piloting their own digital currencies, indicating a shift in how we perceive money. The implementation of CBDCs has the potential to reshape the global financial landscape by:

- Encouraging Global Cooperation: The rise of CBDCs could lead to increased cooperation between countries, particularly in areas related to cross-border payments and trade. As nations adopt their own digital currencies, there may be a push for standardization and interoperability, making it easier for businesses to engage in international commerce.

- Addressing Cryptocurrency Challenges: CBDCs can also serve as a response to the challenges posed by cryptocurrencies. By offering a regulated digital currency, central banks can provide consumers with a stable and secure alternative to the volatility often associated with cryptocurrencies. This stability can encourage more people to participate in the digital economy without fear of significant financial loss.

- Shaping Consumer Behavior: The widespread adoption of CBDCs may change how consumers perceive and use money. As digital currencies become more mainstream, people may prioritize digital transactions over traditional cash payments. This shift in consumer behavior could lead to an overall decline in cash usage, further promoting the need for efficient digital payment systems.

- Enhancing Financial Literacy: The introduction of CBDCs also presents an opportunity to improve financial literacy among consumers. As people engage with digital currencies and learn about their benefits, they will likely become more informed about personal finance and digital payment systems. This enhanced knowledge can lead to better financial decision-making in the long run.

- Driving Technological Innovation: The development of CBDCs will likely spur technological innovation in the financial sector. As central banks and technology companies collaborate to create secure and efficient digital currency solutions, we can expect to see advancements in areas such as cybersecurity, blockchain technology, and user experience design.

Conclusion

The CBDC APK represents a significant advancement in the evolution of finance, offering a range of features and benefits that cater to the needs of modern consumers. By facilitating seamless transactions, enhancing security, and promoting financial inclusion, CBDCs are poised to revolutionize how we engage with money in the digital age. As the world continues to embrace digital solutions, the future of CBDC looks promising, paving the way for a more efficient, inclusive, and innovative financial landscape.

Embracing the potential of CBDCs will not only benefit individuals and businesses but also contribute to the overall health of the global economy. As we look ahead, the CBDC APK stands as a beacon of progress, inviting everyone to join the digital finance revolution.

Let's build community together and explore the coolest world of APK Games/Apps.

1. This is the safest site on the Internet to download APK. 2. Don't ask about the Play Protect warning, we've explained it well, check here. 3. Do not spam, be polite and careful with your words.